General Takaful Car Insurance in Qatar: Affordable and Reliable Coverage #1

Posted on |

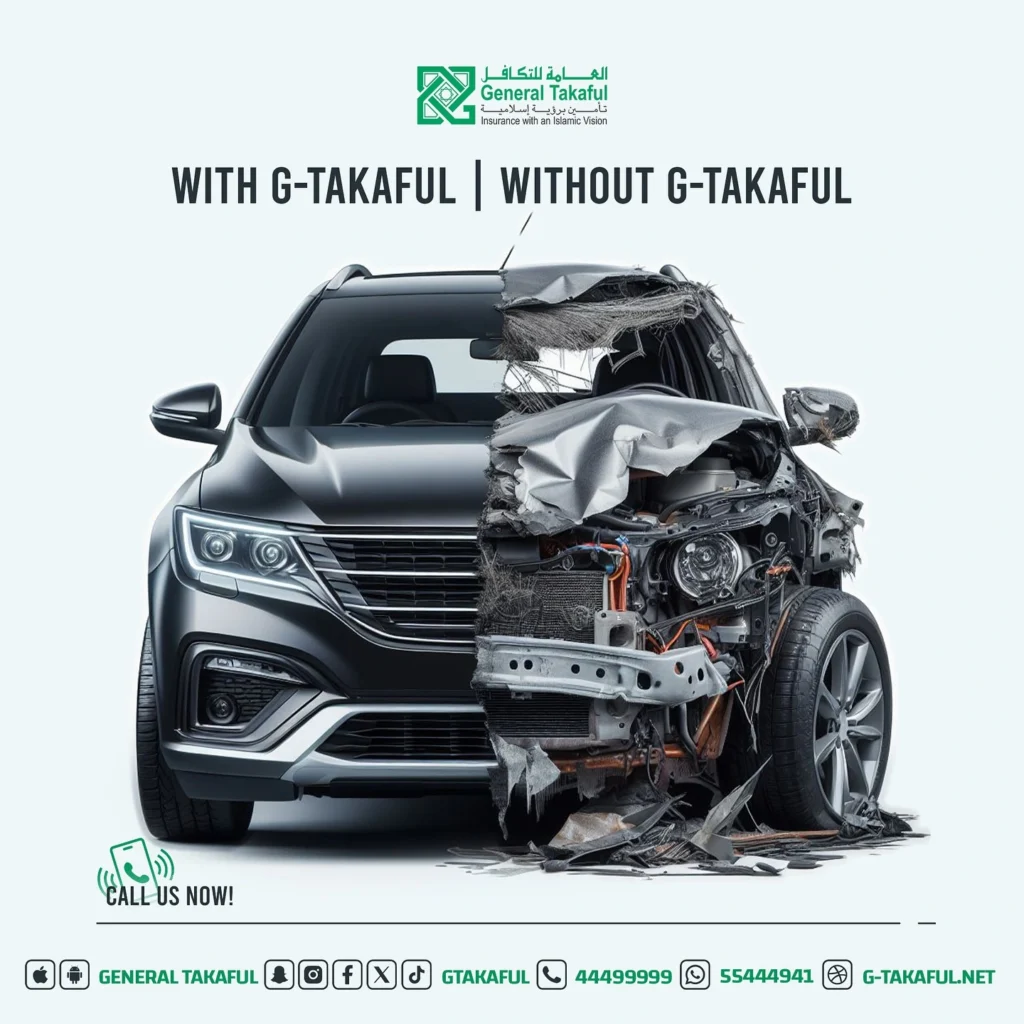

When it comes to securing the best car insurance, General Takaful Car Insurance in Qatar offers reliable and comprehensive coverage at competitive rates.

Whether you’re seeking protection for your own vehicle or third-party liability, General Takaful provides a range of policies tailored to meet your needs.

General Takaful Car Insurance Costs – العامة للتكافل

Comprehensive insurance costs with General Takaful are based on your car’s value. You can expect to pay between 1000 QR and 5000 QR for comprehensive coverage depending on the value of the car and the selected plan. This policy covers damages to your own vehicle as well as any third-party liability, including bodily injury and property damage. For Third-Party Liability (TPL) insurance, costs range from 400 QR to 500 QR.

Buy General Takaful Motor Insurance in Qatar Online

Third-Party Liability (TPL) Insurance

Third-party liability insurance is mandatory under Qatar’s Traffic Law No.6 of 2010. This coverage protects you from financial responsibility for damages or injuries to other people and their property in the event of a traffic accident. TPL insurance is a cost-effective solution, covering everything from vehicle repairs to medical expenses for the affected parties.

Comprehensive Motor Insurance

With comprehensive motor insurance, you’re covered for both damage to your vehicle and third-party liabilities. General Takaful’s comprehensive plan offers extensive protection, ensuring you’re shielded from unexpected accidents, damage, or theft. This policy is essential for anyone looking to safeguard their vehicle, offering peace of mind when driving in Qatar.

Optional Roadside Assistance Coverage

General Takaful Car Insurance also provides a range of optional roadside assistance services to enhance your coverage. These add-ons are designed to help you in case of unforeseen situations, ensuring you’re never left stranded.

- Towing or Removal of Vehicle Service: In case of an accident or breakdown, your vehicle will be towed to the nearest workshop.

- Flat Tire Service: If you get a flat tire, a technician will be dispatched to replace it with your spare. If no spare is available, your vehicle will be taken to the nearest repair shop.

- Fuel Delivery Service: If your vehicle runs out of fuel, General Takaful will deliver fuel to your location.

- Dead Battery Service: In case your vehicle won’t start due to a dead battery, a technician will jump-start your car.

- Lock-Out Service: If you lock your keys inside your vehicle, a technician will be sent to assist you.

Why Choose General Takaful Car Insurance?

- Affordable Pricing: With comprehensive insurance between 1000 QR and 3000 QR depending on the value of the car and the selected plan. and TPL costs between 400 QR and 500 QR, General Takaful offers competitive rates.

- Optional Coverage: Additional services like roadside assistance make General Takaful a great choice for motorists looking for enhanced support.

- Easy Claims Process: With a dedicated WhatsApp claim service, filing a claim is fast and efficient.

How to Get Started

For any inquiries or to get started with your General Takaful Car Insurance, reach out to their customer service team: Buy General Takaful Motor Insurance in Qatar Online

- WhatsApp Inquiries: 55444941

- WhatsApp Motor Claims: 55225570

- Website: www.g-takaful.net

- Email: info@g-takaful.net

You can also download their mobile apps, available on both Android and iOS, to manage your policy on the go.

By choosing General Takaful Car Insurance in Qatar, you’re opting for affordable, comprehensive coverage that ensures your vehicle is protected at all times. With easy access to roadside assistance and reliable customer service, driving in Qatar has never been safer.